Contact Us

Our Mission

NGEFI is built on the idea that the future of finance lies at the intersection of decentralized technology and traditional business growth. As a forward-thinking venture capital firm, we support innovative crypto projects and promising U.S. small businesses that meet regulatory standards. By combining strategic funding with hands-on expertise, we help businesses thrive in an ever-evolving market.

Our Vision

At NGEFI, we envision a world where crypto and small businesses work in harmony, driving economic growth and shaping the future. We focus on creating value through a deep understanding of both sectors and by providing tailored investment strategies to maximize long-term success.

Our Mission

NGEFI is built on the idea that the future of finance lies at the intersection of decentralized technology and traditional business growth. As a forward-thinking venture capital firm, we support innovative crypto projects and promising U.S. small businesses that meet regulatory standards. By combining strategic funding with hands-on expertise, we help businesses thrive in an ever-evolving market.

Our Vision

At NGEFI, we envision a world where crypto and small businesses work in harmony, driving economic growth and shaping the future. We focus on creating value through a deep understanding of both sectors and by providing tailored investment strategies to maximize long-term success.

What We Do

NGEFI provides comprehensive investment services in both blockchain and small business sectors. Our goal is to drive progress by offering more than just capital — we provide:

Strategic Guidance to help our partners navigate challenges and scale effectively.

A Network of Opportunities, connecting you with industry experts, developers, and partners.

Regulatory Compliance to ensure all investments meet U.S. financial standards.

Venture Capital Firms

Venture capital firms specialize in early-stage and high-growth companies. They provide funding to startups and emerging businesses with significant growth potential. Venture capital firms typically invest in technology, healthcare, and other innovative industries.

Buyout/Leveraged Buyout Firms

Buyout firms, also known as leveraged buyout (LBO) firms, focus on acquiring mature companies and improving their performance to generate substantial returns. These firms often use significant debt financing to acquire controlling interests in established businesses.

Growth Capital Firms

Growth capital firms provide funding to established companies looking to expand, enter new markets, or develop new products. They typically invest in companies that have demonstrated strong growth potential and require capital for scaling their operations.

Each type of private equity firm has its own characteristics and investment preferences. Understanding these differences can help entrepreneurs, business owners, and investors determine which type of private equity firm aligns best with their needs and goals.

| TYPE OF PRIVATE EQUITY FIRM | INVESTMENT FOCUS | STAGE OF COMPANIES TARGETED |

|---|---|---|

| Venture Capital Firms | Early-stage, high-growth industries | Startups and emerging companies |

| Buyout/Leveraged Buyout Firms | Mature companies, turnaround opportunities | Established businesses |

| Growth Capital Firms | Companies with strong growth potential | Established companies seeking expansion |

Post-Investment Management

Once an investment is made, private equity firms actively engage with the target company to drive growth and enhance value. They work closely with the company's management team to implement strategic initiatives, improve operations, and optimize performance.

Exit Strategy

Private equity firms typically have a predetermined exit strategy for each investment. This may involve selling the company through an initial public offering (IPO), a merger or acquisition, or a secondary sale to another investor.

Why NGEFI?

Dual Focus on Crypto & Small Businesses: Our unique approach allows us to bridge the gap between digital finance and traditional commerce, fostering growth in both sectors.

Industry Expertise: Our team has years of experience in both blockchain technology and small business development.

Commitment to U.S. Regulation: We pride ourselves on adhering to U.S. regulatory standards for small business investments, ensuring compliance and security.

Frequently Asked Questions

What is the main focus of NGEFI’s investments?

We focus on both crypto investments in blockchain technologies and small business investments within the United States, ensuring all investments comply with regulatory guidelines.

How can I apply for funding or investment?

You can apply by contacting us through the Get in Touch section on our website or email us directly at "[email protected]". We review all applications and discuss opportunities with potential partners directly.

What types of businesses does NGEFI invest in?

We invest in small businesses across the U.S. that show strong growth potential, meet regulatory standards, and operate in industries poised for long-term success.

How does NGEFI assist in crypto projects beyond funding?

We provide advisory support, market insights, and connections to partners and developers within the crypto space to help projects scale and succeed.

What are the regulatory requirements for small businesses to qualify for NGEFI’s investment?

All businesses must meet U.S. regulatory criteria, including compliance with SEC regulations, financial reporting standards, and industry-specific guidelines.

Does NGEFI provide international crypto investments?

Yes, we focus globally on crypto projects, but our small business investments are limited to those within the United States.

Get In Touch

Email: [email protected]

Assistance Hours:

Mon - Fri 9:00am - 6:00pm

Sat- Sun CLOSED

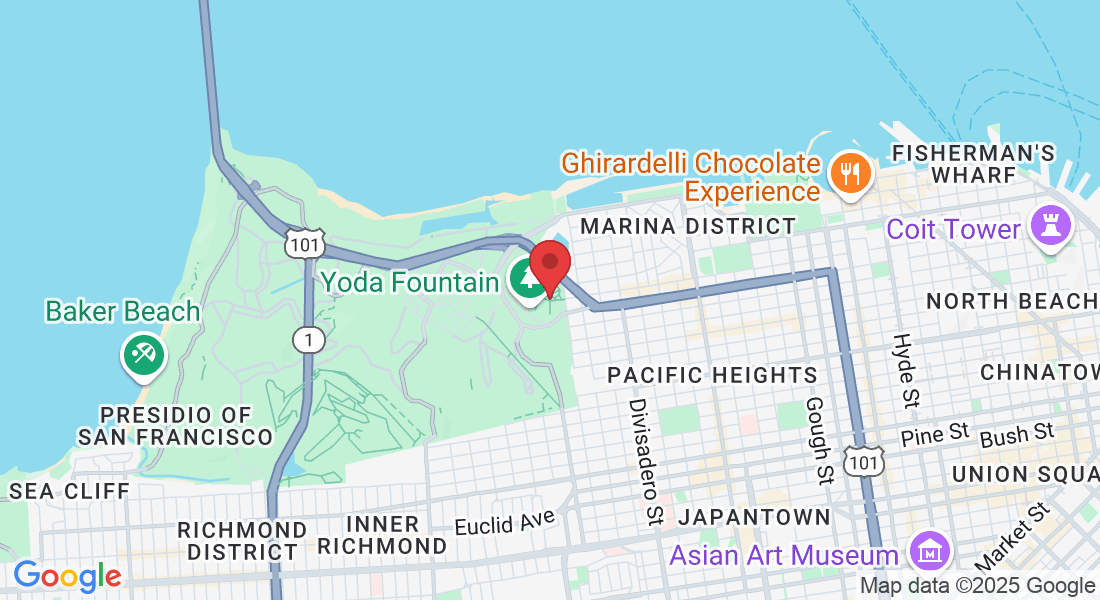

Administrative Headquarters:

1 Letterman Drive

San Francisco, CA 94129

Working hours:

Mon to Fri:

10:00 am – 6:00 pm

Sat & Sun:

Closed